Get the free dd 1351 3 form

Show details

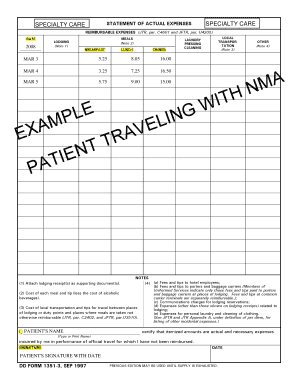

STATEMENT OF ACTUAL EXPENSES REIMBURSABLE EXPENSES (JR, par. C4601 and CFTR, par. U4205) DATE LODGING (Note 1) MEALS (Note 2) BREAKFAST LUNCH DINNER LOCAL TRANSPORTATION (Note 3) LAUNDRY PRESSING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your dd 1351 3 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dd 1351 3 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dd 1351 3 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dd form 1351 3. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out dd 1351 3 form

How to fill out DD 1351-3?

01

Start by entering the traveler's name, Social Security Number, and grade/rank on the top right-hand corner of the form.

02

Fill in the date of the travel and the destination in the respective fields provided.

03

Indicate the organization and station from where the travel is authorized.

04

Specify the mode(s) of transportation used during the travel, such as air, rail, or privately owned vehicle (POV). Provide the necessary details like flight numbers or vehicle information.

05

Fill out the reverse side of the form for any additional accounting information or remarks related to the travel.

06

Prepare an itinerary of the trip, including departure and arrival dates and times, as well as the purpose of the travel.

07

If applicable, indicate any advance payments or reservations made for lodging, rental car, or other expenses.

08

List all expenses incurred during the travel, such as meals, transportation, and lodging, in the designated fields.

09

Calculate the total amount of expenses and ensure it reconciles with the receipts attached.

10

Sign and date the form before submitting it to the appropriate approving authority.

Who needs DD 1351-3?

01

Active duty military personnel who are planning official travel.

02

Reserve and National Guard members on active duty orders.

03

Civilian employees of the Department of Defense (DoD) and other authorized personnel conducting official travel on behalf of the government.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dd 1351 3?

DD Form 1351-3 is a Department of Defense (DoD) form used to request reimbursement for official travel expenses incurred by military and civilian personnel. It is specifically used for Temporary Duty (TDY) travel and can be submitted to obtain reimbursement for lodging, meals, transportation, and other related expenses.

Who is required to file dd 1351 3?

The DD Form 1351-3, also known as the "Joint Travel Regulation (JTR) Travel Voucher or Subvoucher," is required to be filed by members of the military, civilians, and contractors who have incurred authorized travel expenses related to official government travel. This form is used for reimbursement of these expenses.

How to fill out dd 1351 3?

To fill out DD Form 1351-3, follow these steps:

1. Start by entering the date in the "DATE" field at the top-right corner of the form.

2. In the "NAME" field, enter the name of the military member who incurred the expenses.

3. In the "GRADE" field, enter the rank or grade of the military member.

4. In the "SSN" field, enter the Social Security Number of the military member.

5. In the "DODAAC" field, enter the Department of Defense Activity Address Code. This is used to identify the accounting station.

6. In the "ORGANIZATION" field, enter the name of the military organization to which the member belongs.

7. In the "STATION" field, enter the military installation where the expenses were incurred.

8. In the "APPROPRIATION AND STATION WHERE VOUCHER MUST BE RETURNED" section, enter the appropriate information that reflects where the completed voucher should be sent.

9. In the "GENERAL INSTRUCTIONS" section, read through the instructions and ensure you understand the requirements for submitting the voucher.

10. In the "PAYEE" section, enter the payee's name, address, city, state, ZIP code, and telephone number.

11. In the "TRAVEL ORDER NUMBER" field, enter the travel order number that authorized the expenses.

12. In the "SSN" field, enter the payee's Social Security Number.

13. In the "EXPECTED DATE OF RETURN" field, enter the expected date of the payee's return to the permanent duty station.

14. In the "TRANSACTION TYPE" field, select the appropriate option that matches the purpose of the claim (e.g., travel voucher, relocation voucher).

15. In the "FOR" field, enter a brief description of the expenses being claimed.

16. In the "TRANSACTION DATE" field, enter the date(s) on which the expenses were incurred.

17. In the "METHOD OF AUTHORIZATION" field, select the appropriate option that reflects how the expenses were authorized.

18. In the "ACCOUNTING CLASSIFICATION" section, enter the appropriate accounting codes for the expenses being claimed.

19. In the "ESTIMATED EXPENSES INCURRED" section, enter the estimated expenses related to travel, including transportation, lodging, meals, and other authorized expenses.

20. In the "ACTUAL EXPENSES INCURRED" section, enter the actual expenses that were incurred, if different from the estimated expenses.

21. In the "CERTIFICATION" section, the payee must certify the accuracy and truthfulness of the information provided.

22. In the "DATE" field at the bottom-right corner of the form, the payee must sign and date the voucher.

23. Once completed, submit the form according to the instructions provided by your unit or the appropriate finance office.

Remember to keep copies of all supporting documentation (e.g., receipts) for your records.

What is the purpose of dd 1351 3?

The DD Form 1351-3, also known as the Travel Voucher or Subvoucher, is a form used by members of the United States military to request reimbursement for official travel expenses. It serves as a record of the expenses incurred during authorized travel, including lodging, meals, transportation, and any other relevant costs. The purpose of the form is to facilitate the reimbursement process and ensure that service members are compensated for their eligible expenses.

What information must be reported on dd 1351 3?

The DD Form 1351-3, also known as the Travel Voucher or Subvoucher, is used by military members to claim reimbursement for official travel expenses. The information that must be reported on this form includes:

1. Personal information: Name, grade/pay grade, social security number, and mailing address of the traveler.

2. Trip information: Date of travel, purpose of travel, and mode of transportation.

3. Itinerary: Detailed listing of places visited, including departure and arrival dates and times.

4. Expenses: Itemized list of expenses incurred during the trip, such as lodging, meals, transportation, and miscellaneous expenses.

5. Amount claimed: The total dollar amount being requested for reimbursement.

6. Receipts: Attachments of original receipts or supporting documents for each claimed expense exceeding $75.

7. Certification: Signature and date by the traveler, verifying the accuracy and legitimacy of the claim.

It is important to note that specific requirements may vary based on individual situations and regulations.

What is the penalty for the late filing of dd 1351 3?

The penalty for the late filing of DD Form 1351-3 is determined by the specific circumstances of the late filing and the policies of the organization involved. In some cases, there may be no penalty at all, while in others, there could be consequences such as delayed reimbursement or potential disciplinary action. It is important to consult the relevant regulations, guidelines, or instructions provided by the specific organization or entity that requires the form for accurate information on penalties for late filing.

How can I manage my dd 1351 3 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your dd form 1351 3 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute 1351 3 online?

Completing and signing dd 1351 3 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit dd form 1351 3 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 1351 3, you can start right away.

Fill out your dd 1351 3 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1351 3 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.